Understanding the FIRE Movement

The FIRE movement, which stands for Financial Independence, Retire Early, is a growing trend advocating for individuals to take control of their financial futures. Its primary philosophy revolves around wealth accumulation through aggressive saving and strategic investing, enabling participants to retire significantly earlier than the traditional retirement age. Central to the movement is the belief that financial independence allows individuals greater freedom in how they utilize their time.

At its core, the FIRE movement encourages a lifestyle characterized by frugality, intentional spending, and conscious financial planning. Adherents are often committed to saving a substantial portion of their income—generally, 50% or more—over several years. This approach often necessitates lifestyle changes, including downsizing living expenses, minimizing debt, and avoiding lifestyle inflation. The objective is to build a nest egg large enough to support living expenses for an extended period, usually through investment returns.

Investing plays a crucial role in the FIRE movement. Many supporters focus on low-cost index funds, real estate, and other investment vehicles that can yield passive income. The goal is to create a diversified portfolio that generates sufficient returns, allowing FIRE participants to withdraw funds without depleting their savings too quickly. By achieving financial independence, individuals can leave behind the constraints of traditional employment, allowing themselves to engage in activities they are passionate about.

Moreover, the benefits of achieving financial independence extend beyond monetary freedom. Participants often report enhanced well-being, reduced stress levels, and the ability to invest time in volunteer work, travel, or pursuing entrepreneurial endeavors. Thus, the FIRE movement fundamentally reshapes the way individuals view work, money, and personal fulfillment in the context of their lives. For more insights, explore the Mr. Money Mustache blog, a popular resource on financial independence and early retirement.

The Importance of Time in Investing

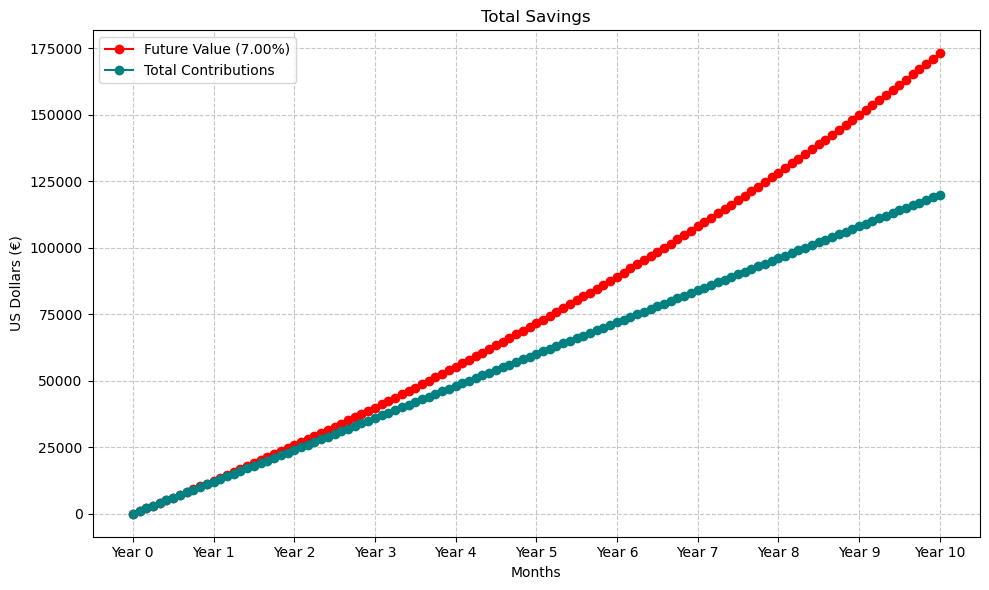

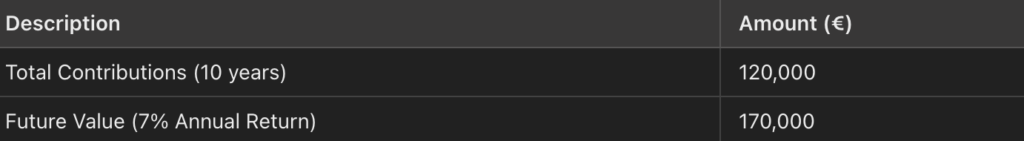

“Time plays a crucial role in the investment process, serving as one of the most valuable assets an investor possesses. Understanding the significance of time can lead to substantial financial growth, primarily through the effects of compound interest. This principle refers to the method by which an investment earns returns not only on the initial principal but also on the accumulated interest from previous periods. As time progresses, the power of compound interest magnifies, enabling even modest investments to grow disproportionately large. Try out our compound interest calculator to see how time can enhance your investments.”

For instance, consider two individuals: one starts investing $1,000 annually at the age of 20 and the other begins the same investment at 30. Assuming an average annual return of 7%, the first individual, after 40 years, would accumulate approximately $1.15 million, while the second would only amass about $570,000. This example underscores the importance of beginning the investment journey as early as possible. By allowing investments to compound over a more extended period, individuals can significantly enhance their financial prospects.

Moreover, it’s important to recognize that time is not merely an ally for those who start early; it also mitigates risks associated with market volatility. Long-term investing allows market fluctuations to stabilize, providing the potential for higher average returns over time. Historical data shows that, despite short-term market dips, equity markets tend to rise over multi-decade spans. Investing small amounts consistently, through strategies like dollar-cost averaging, can capitalize on time by reducing the impact of market volatility on overall returns. Even minor contributions to an investment portfolio can yield impressive outcomes if allowed the time to mature.

In summary, time is of the essence in investing. Recognizing its pivotal role and leveraging it through strategies that promote early and consistent investment can pave the way towards achieving financial independence and long-term wealth accumulation.

Strategies for Effective Early Investing

The FIRE (Financial Independence, Retire Early) movement emphasizes the importance of investing early to accumulate wealth and achieve financial freedom. For those embarking on their investment journey, understanding various investment vehicles is essential. Key options include stock market investments, real estate, index funds, and retirement accounts. Each of these vehicles offers unique benefits and considerations that can help align one’s financial goals with the principles of the FIRE movement.

Among the most popular investment options, stock market investments and index funds present opportunities for significant long-term growth. By investing in index funds, individuals can enjoy diversification across a wide array of stocks, reducing the impact of volatility. This approach often suits early investors, as it requires less time than active trading while still providing substantial potential returns. Additionally, real estate remains a viable avenue for building wealth, offering both appreciation and rental income, which can foster financial independence.

Building a diversified portfolio is crucial for effective early investing. It minimizes risk by spreading investments across multiple asset classes, thereby shielding one’s financial plan from large losses in any single area. Alongside diversification, risk management plays a pivotal role in safeguarding investments. Early investors should evaluate their risk tolerance and adapt their asset allocation accordingly, balancing higher-risk assets with more stable options.

Financial literacy can greatly enhance an investor’s confidence and capability. Investors are encouraged to educate themselves on market trends, investment strategies, and personal finance principles. This knowledge empowers them to make informed decisions, leading to better investment outcomes. Furthermore, mastering budgeting techniques can free up additional capital for investment. By assessing monthly expenses and identifying unnecessary expenditures, individuals can redirect funds towards their financial goals, accelerating their path to financial independence.

Real-Life Success Stories and Lessons Learned

The journey towards achieving financial independence through the FIRE (Financial Independence, Retire Early) movement has inspired many individuals to transform their lives. Each person’s path reflects unique experiences, strategies, and challenges, crafting a rich tapestry of stories that offer valuable insights for those considering this lifestyle change.

One of the prominent success stories is that of Mr. and Mrs. Money Mustache, a couple who retired early in their 30s. They focused on drastically reducing living expenses by moving to a modest home and cycling instead of driving. Their disciplined approach to saving and investing, primarily in index funds, enabled them to accumulate wealth while enjoying frugal yet fulfilling lives. This couple emphasizes that community, often neglected in financial discussions, plays a critical role in maintaining motivation and support during the journey toward financial independence.

Another notable story is that of a corporate worker who adopted the FIRE strategy after becoming discontent with his 9-to-5 routine. After realizing the value of time over money, he committed to side hustles, such as freelancing and participating in the gig economy, which significantly boosted his income. Although he faced several setbacks, such as burnout and discouragement during market downturns, these experiences taught him resilience and adaptability. His journey emphasizes the importance of diversifying income streams and recognizing when to pivot strategies.

While the narratives of FIRE practitioners illuminate pathways to financial independence, they also provide cautionary tales regarding common pitfalls. Many individuals encounter impulsive spending, especially during windfalls. Lessons learned from these experiences underscore the necessity of setting clear, attainable goals and creating budgets that account for potential obstacles. The satisfaction derived from experiences rather than possessions tends to enhance lasting fulfilment. The key takeaways from these stories remind aspiring FIRE practitioners to maintain focus, embrace resilience, and prioritize continuous learning throughout their experiences. By harnessing the lessons learned from these real-life stories, others can chart their paths toward financial independence more effectively.